Legal Remedy When Insurance Claim is Rejected

How to file complaint before consumer commission

Introduction

The insurance is purchased to protect ourselves and our family during difficult times such as illness, accident, death, theft or loss of the property. A policyholder pays a premium regularly with the belief that when the loss occurs, the insurance company will settle the claim honestly and timely. However, in many cases, the insurance company rejects the claims; in such a situation, the consumer is helpless and financially stressed. Many policyholders do not understand why their claim was rejected by the insurance company. Whether the rejection is legal and what remedy is available.

In this article, we discuss the insurance claim rejection by the insurance companies, the reasons for rejection, what precautions the consumer/policyholder should take to avoid rejection, and what legal remedy is available to the consumer/policyholder. We also explain how to file the consumer case before the Consumer Commission, how to decide jurisdiction and complete the process of online filing through the e-jagriti.gov.in portal, along with mandatory physical filing before the Registry of the commission. So that even a common consumer without legal background can understand the procedure.

What is the insurance claim?

The insurance claim is the formal request made by the policyholder to the insurance companies asking for payment or benefit under the insurance policy after an insured event occurs. For example.

- Related to health insurance claim after hospitalization

- Life insurance claim after death or injury.

- Motor insurance claim after the accident

- A fire insurance claim was made after a fire loss occurred.

- Theft insurance claim after burglary.

Important ponit for the consumer. The insurance claim is a request made by the consumer/policyholder to the insurance company to get the compensation or benefits after a covered loss or event occurs under the policy.

Why do insurance companies reject claims?

The insurance companies generally rejected the claim on certain grounds. Some are valid, while many are unfair or technical rejections, which can be challenged in the consumer commission. For example,

- Not disclosing the pre-existing disease in the health insurance.

- Not disclosing previous accidents in the motor insurance

- Not disclosing smoking or drinking habits in life insurance

- Giving wrong or incomplete medical history in health insurance

- claiming treatment during the waiting period of the policy.

- Treatment taken from non network or non-authorised hospital.

- Delay in intimating the insurance company about hospitalization or accident.

- Driving the vehicle without a valid driving license.

- The accident occurred while the vehicle was used for the commercial purpose against the terms and conditions of the policy.

- Delay in reporting the accident or not filing FIR where required

- vehicle was under the influence of alcohol or drugs at the time of the accident.

- Misstatement of age, income, or occupation in life insurance proposal.

- Death occurred due to the lucid within the exclusion period.

- non-payment or lapse of policy premium before the claim event.

- submitting the fake forged or incomplete documents

- claim raised for the loss not covered under the policy.

- violation of the terms and conditions of the policy.

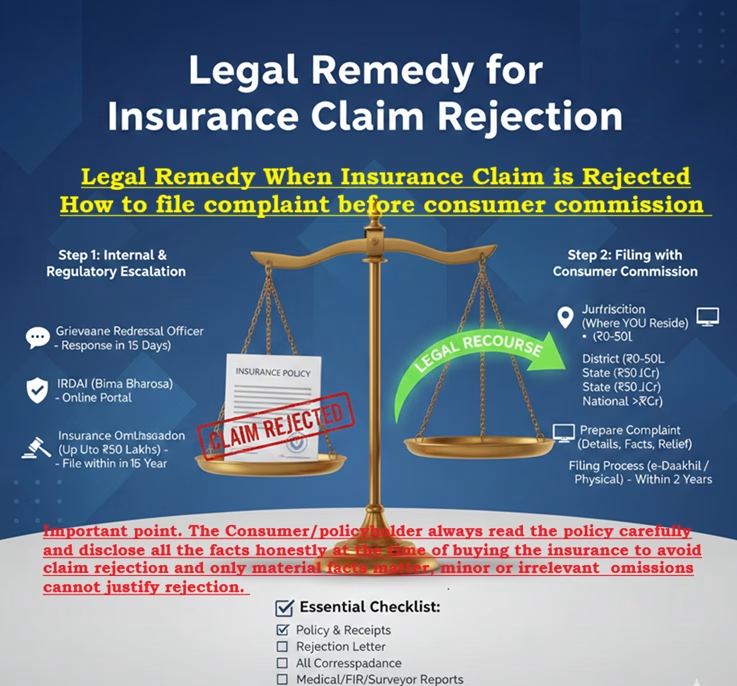

Important point. The consumer/policyholder always reads the policy carefully and discloses all the facts honestly at the time of buying the insurance to avoid claim rejection and only material facts matter; minor or irrelevant omissions cannot justify rejection.

Policy Lapse due to the Non-payment of the Premium

If the premium is not paid within the grace period and the policy lapses, the claim may be rejected by the insurance company.

The claim is not covered under the terms and conditions of the policy.

The insurance policies work strictly on terms and conditions. For example,

- Cosmetic surgery is excluded in health insurance

- Death due to suicide within the exclusion period.

- Damage due to the war, nuclear risk or illegal activities.

- claim made after the expiry of the policy

- non-disclosure of the previous disclosure

- due to the natural calamities not covered.

- over insurance or duplicate insurance claims.

- non-compliance with the insurance policy terms and conditions.

- misuse of policy benefits.

- incorrect claim form or documents submit

Important point after buying the policy.

- The consumer pays the premium on time.

- Keep the policy document safe.

- Inform the insurance company/insurer immediately after the incident.

- Maintain all bills, reports, FIR, photos.

- Follows the claim procedure strictly.

Important Point for the Consumer/Policyholder Regarding the Insurance Claim.

- The consumer/policyholder always reads the policy carefully before buying the insurance. The consumer understands all the terms and conditions of the policy, exclusions, and waiting periods.

- Discloses all the facts honestly while the consumer is buying the insurance policy. Only material facts matter; minor or irrelevant omissions cannot justify rejections.

- The consumer pays the premium on time to avoid lapse. The lapsed policy can lead to claim rejection.

- The consumer keeps the policy documents safe and always keeps a copy of the proposal forms.

- The consumer informs the insurance company immediately after an accident or loss occurs. Delay may lead to rejection.

- The consumer submits the correct and complete document with your claim. like bills, FIR, discharge summary, photos, and any other document required.

- The consumer never submits the fake or altered documents, inflated bills or false information; fraud can lead to permanent rejection.

- The terms and conditions of the policy are strict: do not drive without a valid license (for motor insurance), do not consume alcohol before the accident event, and do not violate policy-specific clauses.

- The consumer keeps all communication in writing, emails, and WhatsApp messages; these may help the consumer if the claim is rejected.

What to do when the claim is rejected

- If the claim is rejected, the consumer/policyholder first read the rejection letter carefully and understand the reason and

- send the detailed representation to the insurance company and attached all supporting documents

- Approached the insurance ombudsman (Optional) if the claim amount is within the ombudsman limit (This is optional, not mandatory)

- File the consumer complaint; if the claim is still not settled, the consumer can file the consumer complaint before the Consumer Dispute Redressal Commission.

Legal Remedy Available to the policyholder under the consumer protection Act, 2019

The rejection of a valid claim amounts to a deficiency in service and an unfair trade practice.

The Consumer can seek

- Claim amount

- Compensation for mental agony

- Litigation expenses/cost

- interest on the delayed payment

Which consumer commission has jurisdiction

Under the Consumer Protection Act, 2019, the jurisdiction of the commission depends on the amount paid by the consumer (e.g., the premium paid or the claim amount relevant to the policy), not on the compensation sought in the complaint.

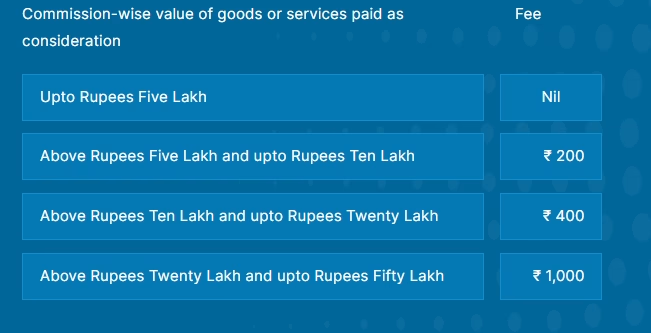

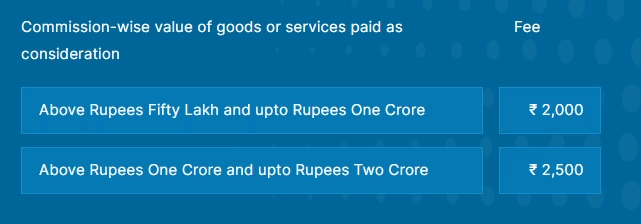

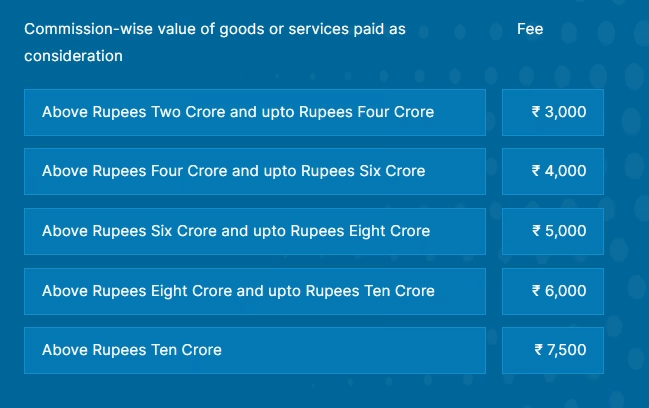

Commission Amount Paid/Considered

- District Commission Up to Rs 50 Lakhs

- State Commission Above 50 Lakh to 2 Crores

- National Commission Above 2 Crores.

Important Note:- The amount considered for jurisdiction is only the amount paid to the insurer/insurance company, not any additional compensation or interest claimed by the consumer/policyholder.

Territorial Jurisdiction

The Consumer can file the complaint where

- The Consumer resides or work

- The insurer/insurance company office is located

- The cause of action arose (Incident or rejection)

Note:- The consumer can choose any of these locations to file the consumer complaint.

Limitation period for filing the consumer complaint

The consumer can file the consumer complaint within two years from the date of cause of action (usually the date of the claim rejection)

Delay can be condoned if sufficient reasons are shown.

How to file a consumer complaint before the Consumer Commission.

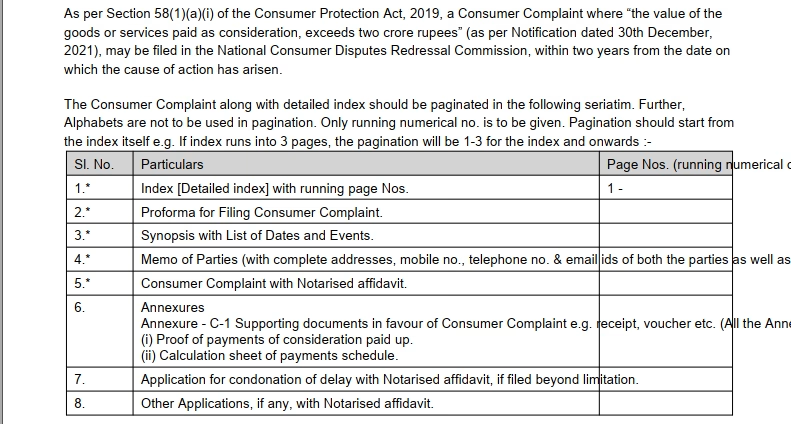

The consumer, first, properly checks the jurisdiction and drafts their complaint carefully and attaches all the relevant documents to the complaint and verifies the prescribed format from the official consumer commission website.

Thereafter visit the e-jagriti.gov.in portal and create an ID/profile on the portal and file the complaint by preparing it in separate parts, such as,

- Index

- consumer format

- Pleading affidavit

- Memo of parties

- List of dates and events

- Complaint with supporting affidavit.

- Annexures/documents such as bills, receipts, chat and email proof

- Aadhar card of the complainant

- Vakalatnama (if filed through an advocate)

Upload all the documents on the e-jagriti.gov.in portal and submit the complaint online. After online filing the complaint, the consumer submits the original set along with two photocopies before the Consumer Commission; one copy is served to the respondent/opposite party and one photocopy is kept for your own record.

After submission before the Consumer Commission, the commission will provide you with a case number and admission hearing date.

How to file consumer complaint read this article for proper guidance Click Here

How to file online on e-jagriti.gov.in portal step by step guide Click Here

After filing the complaint.

The Commission,

- notice is issued to the insurance company/insured

- The commission directed the insurance company to file a reply within 30 days from the date of receipt of the notice.

- The commission directed to file the evidence to both the parties

- The commission direct to file the rejoinder (if any)

- The Commission direct to file the relevant documents

- The commission direct to file the written arguments

- The commission will hear properly both the parties

- The commission gives the final order/judgement.

Importance of Consumer Protection Law.

The Consumer Protection Act, 2019, is beneficial legislation aimed at protecting the consumer rights. The insurance company is a service provider and is accountable under the consumer protection law.

In view of the above facts, the insurance claim rejection is the serious issue faced by the many consumer in India. While the insurance companies have the right to verify claims, rejection not be arbitrary, unfair or unreasonable. The Consumer must remain aware fo their right, take necessary precautions and not hesitate to seek the legal remedies.

Filing of consumer complaint in the consumer commission is an effective and affordable way to challenge the wrongful claim rejection.

For more update visit Home Click Here

Disclaimer

This contents is for general information and educational purposes only and does not constitute legal advice. Law and procedures may change and vary by case. The readers are advised to verify details from the official sources and before taking any legal action, the consumer/policyholder consult with qualified an advocate/lawyer.

this is one of the best article i read today, i enjoy reading how you structure this article, keep up the good work, my site is the best webdesign freelancer in berlin in Germany, https://webdesignfreelancerberlin.de/ you can check it out. Thank you